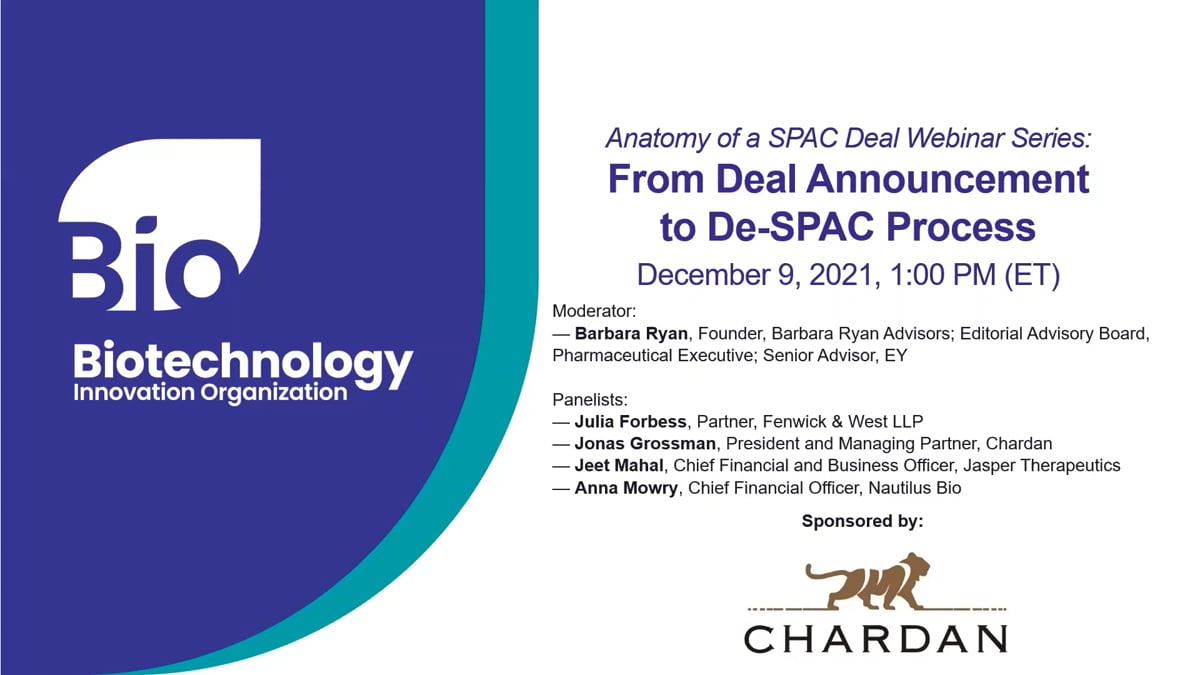

BIO-Chardan Webinar: From Deal Announcement to De-SPAC Process

BIO-Chardan Webinar: From Deal Announcement to De-SPAC Process

December 9, 2021

A private biotech that announces a definitive agreement with a SPAC jumps into the public investor spotlight and faces that attention with fewer guardrails than the IPO process, plus a need to transform board, investor, and regulatory relations. Given that most SPAC merger deals also involve follow-on PIPE investment rounds or other transactions, the full fundraising benefits of the deal strategy require a smooth de-SPAC process that a private biotech would never have encountered before. View this webinar to learn best practices for navigating from SPAC deal announcement through de-SPAC process to regular life managing a publicly traded company.

Moderators & Speakers

.png)