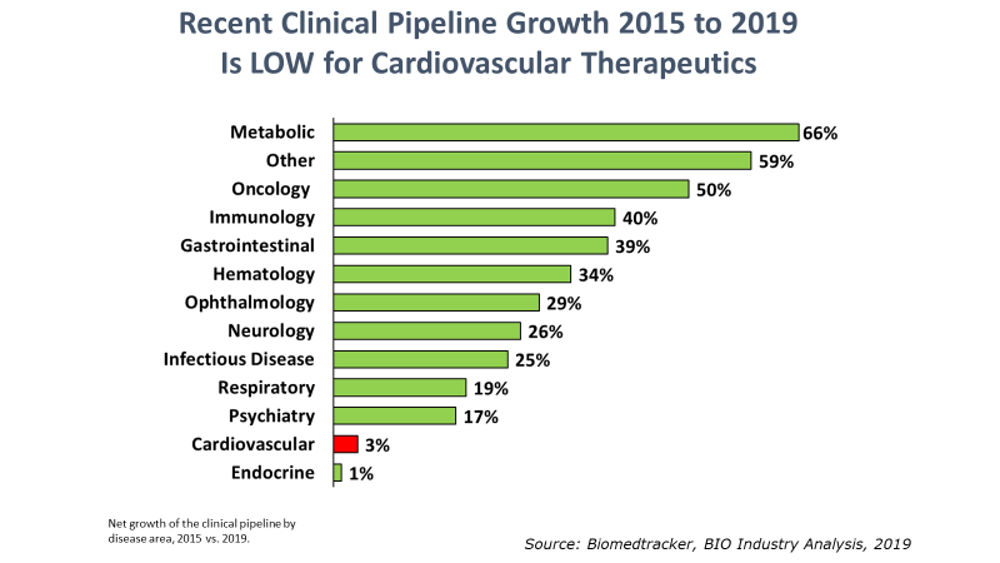

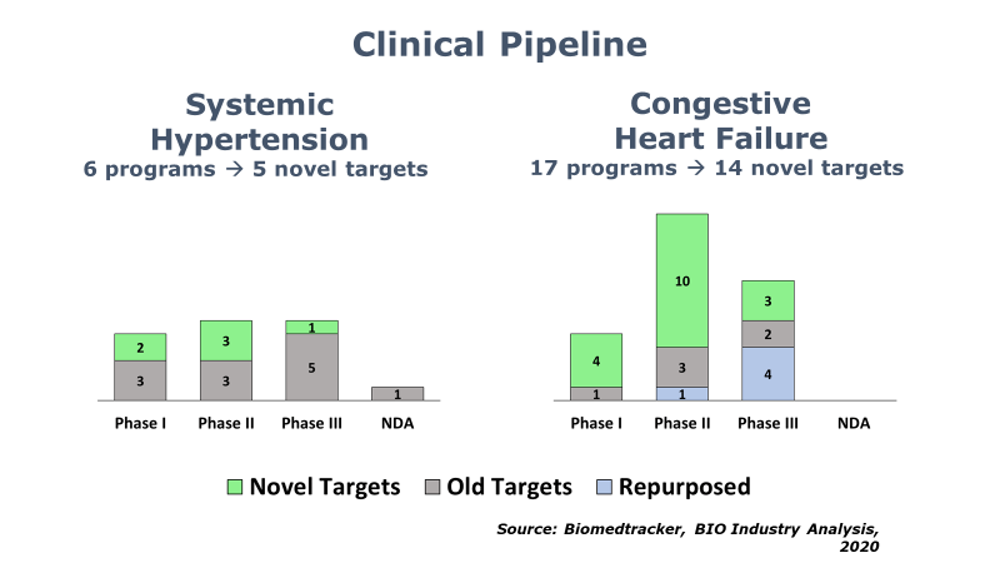

BIO’s Industry Analysis team has published its 5th report in a series on the innovation landscape of highly prevalent, chronic diseases. This new report [available here] reviews the state of drug development for hypertension and heart failure. As with the prior reports, the investigation into these cardiovascular indications is meant to help industry stakeholders identify and understand the extent of any R&D contraction for these indications. Thus far, we have identified a broad contraction of R&D in depression, pain, addiction, type II diabetes, and obesity.

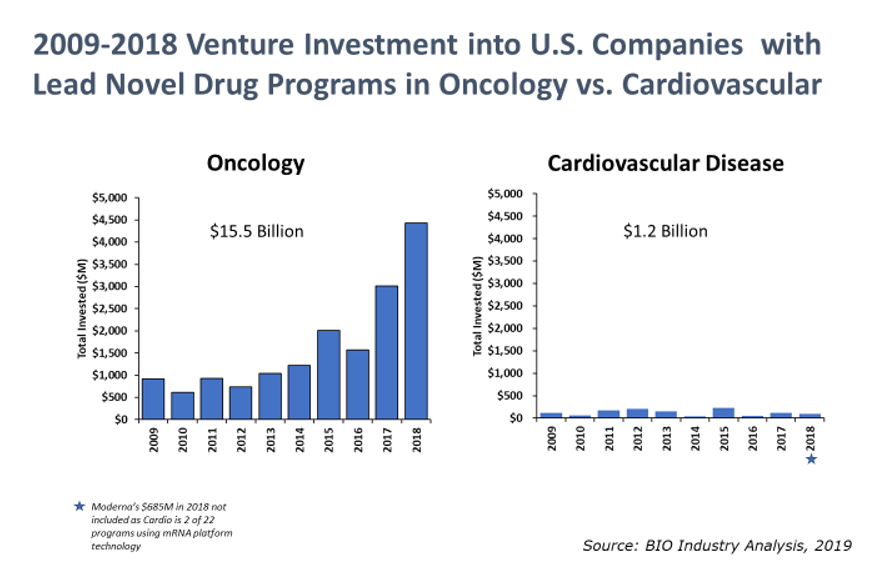

The cause for concern is magnified by the impact these chronic disease areas have on the overall healthcare system in the U.S. For cardiovascular disease alone, the American Heart Association estimates current direct costs at $277 billion annually in the U.S. and expects direct costs to grow to $655 billion by 2035.1 Although these current and projected costs for cardiovascular disease are staggering, venture capital investment for cardiovascular-focused therapeutic companies in the U.S. remains 13 times lower than oncology-focused companies.

.jpeg?itok=ByJuBfy-)

.png)